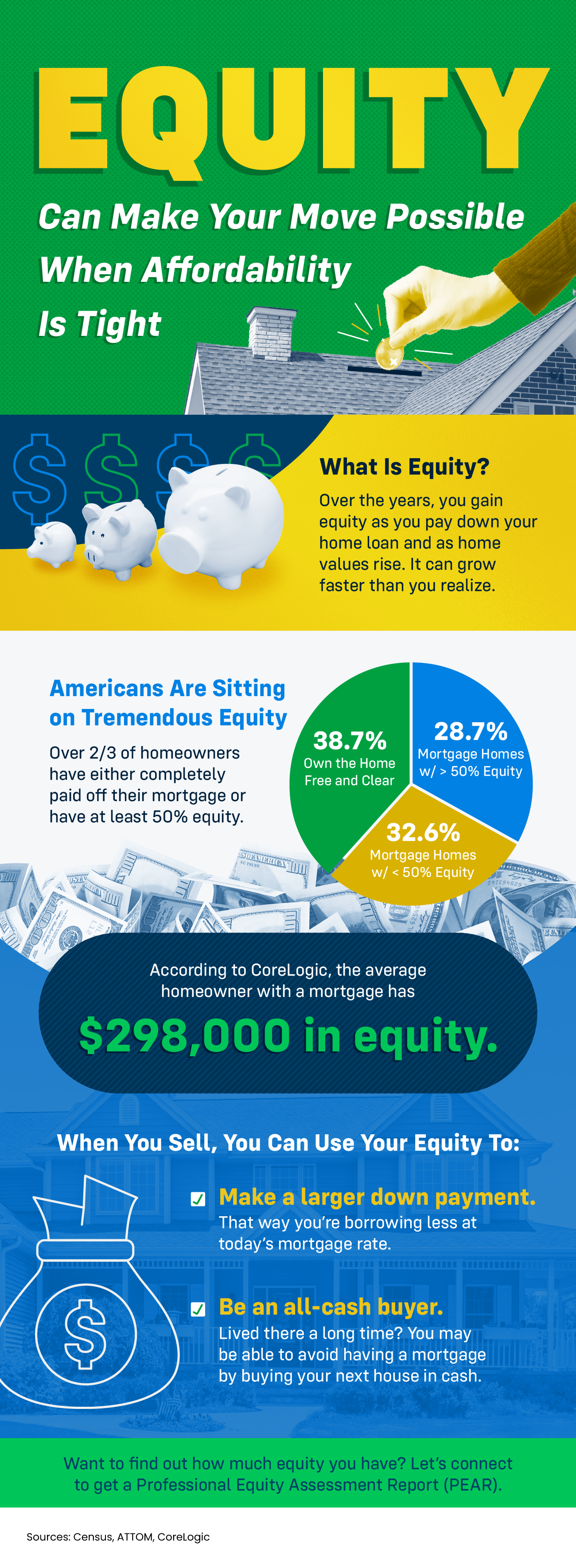

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240427/16/original_b15bceaf-9a4c-45d4-bd69-b04c7cd9e9cc.png)

Some Highlights

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

- All Blogs (751)

- agent (180)

- baby boomers (184)

- best realtor (118)

- buy (188)

- buy a house (191)

- buyer myths (183)

- Buying Myths (184)

- demographics (185)

- Down payment (182)

- For Buyers (186)

- For Sellers (186)

- foreclosures (185)

- gen z (186)

- generation x (186)

- Holidays (183)

- homebuyers (193)

- homeownership (186)

- house maintenance (182)

- house preparation (182)

- housing market updates (184)

- infographics (183)

- Interest Rates (182)

- listing (184)

- Luxury Market (184)

- luxury real estate (183)

- millenials (187)

- mortgage (188)

- mortgages (181)

- pricing (182)

- purchase (189)

- real estate (117)

- realestateexperts (116)

- realtor (118)

- rent vs buy (182)

- Rent vs. Buy (180)

- schools (177)

- sell (185)

- sell a house (182)

- sellers (176)

- sellers market (176)

- selling myths (175)

Recent Posts

Your Equity Could Change Everything About Your Next Move

Why Selling Your House This Winter Gives You an Edge

This May Be the Best Time To Buy a Brand-New Home

Why More Homeowners Are Giving Up Their Low Mortgage Rate

The 3 Housing Market Questions Coming Up at Every Gathering This Season

How To Find the Best Deal Possible on a Home Right Now

Why So Many People Are Thankful They Bought a Home This Year

Why Buying a Home Still Pays Off in the Long Run

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

Most Experts Are Not Worried About a Recession

GET MORE INFORMATION

Thomas Ciccarone

Sales Associate | License ID: 1867455