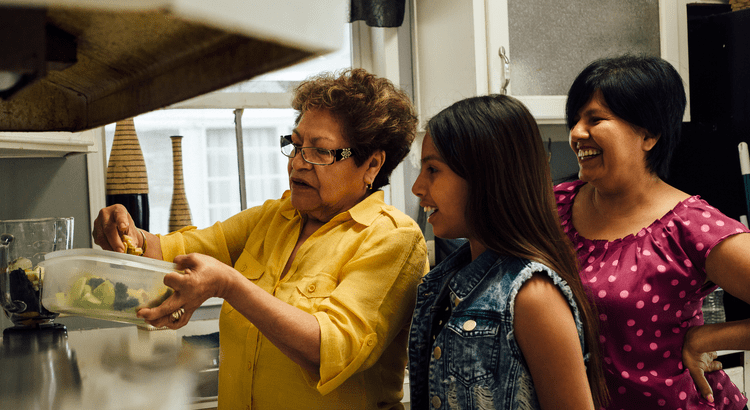

Multi-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below):

And what’s behind the increase? Affordability. NAR explains:

And what’s behind the increase? Affordability. NAR explains:

“In 2024, a notable 36% of homebuyers cited “cost savings” as the primary reason for purchasing a multigenerational home—a significant increase from just 15% in 2015.”

In the past, caregiving was the leading motivator – especially for those looking to support aging parents. And while that’s still important, affordability is now the #1 motivator. And with current market conditions, that’s not really a surprise.

Pooling Resources Can Help Make Homeownership Possible

With today’s home prices and mortgage rates, it can be hard for people to afford a home on their own. That’s why more families are teaming up and pooling their resources.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

But this strategy doesn’t just help with affordability. It may even allow you to get a larger home than you’d qualify for on your own and that gives everyone a bit more breathing room. As Chris Berk, VP of Mortgage Insights at Veterans United, explains:

“Multigenerational homes are more than a trend: They are a meaningful solution for families looking to care for one another while making the most of their homebuying power.”

And momentum may be growing. Nearly 3 in 10 (28%) of homebuyers say they’re planning to purchase a multi-generational home.

Maybe it’s a solution that would make sense for you too. The best way to find out? Talk to a local real estate agent who can help you decide if this option would work for you.

Bottom Line

If your budget feels tight, buying a multi-generational home could be a smart solution.

Would you ever consider buying a home with a family member? Why or why not?

Connect with an agent to talk through your options.

Categories

- All Blogs (757)

- agent (180)

- baby boomers (184)

- best realtor (118)

- buy (188)

- buy a house (191)

- buyer myths (183)

- Buying Myths (184)

- demographics (185)

- Down payment (182)

- For Buyers (186)

- For Sellers (186)

- foreclosures (185)

- gen z (186)

- generation x (186)

- Holidays (183)

- homebuyers (193)

- homeownership (186)

- house maintenance (182)

- house preparation (182)

- housing market updates (184)

- infographics (183)

- Interest Rates (182)

- listing (184)

- Luxury Market (184)

- luxury real estate (183)

- millenials (187)

- mortgage (188)

- mortgages (181)

- pricing (182)

- purchase (189)

- real estate (117)

- realestateexperts (116)

- realtor (118)

- rent vs buy (182)

- Rent vs. Buy (180)

- schools (177)

- sell (185)

- sell a house (182)

- sellers (176)

- sellers market (176)

- selling myths (175)

Recent Posts

GET MORE INFORMATION

Sales Associate | License ID: 1867455